Description

Further information

This extension comes with 12 months of access to updated versions, and support.

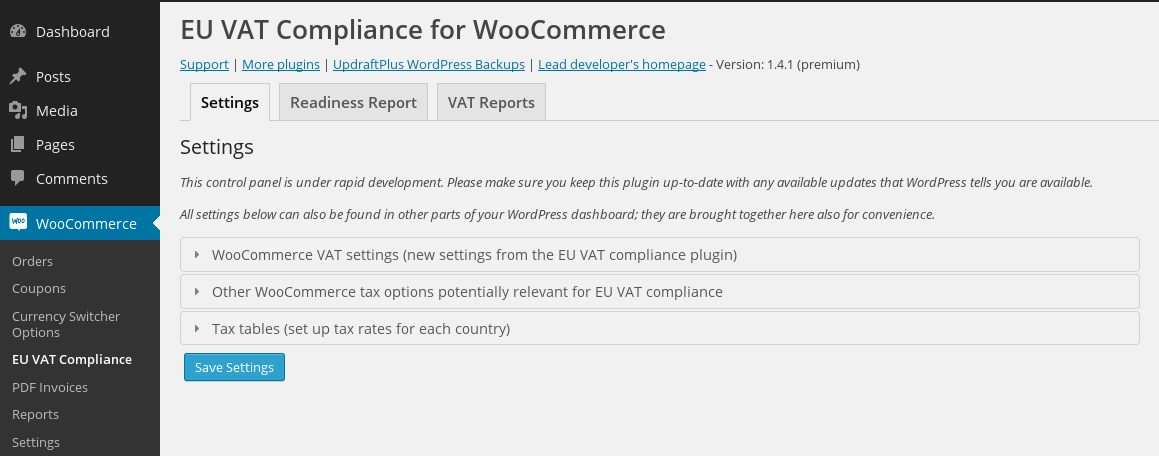

Installation information: install this plugin in the usual way, by going to the Plugins -> Add New -> Upload screen of your WordPress dashboard. Configuration is then found in WooCommerce -> Settings -> VAT Compliance.

For FAQs about this plugin, please follow this link.

Screenshots

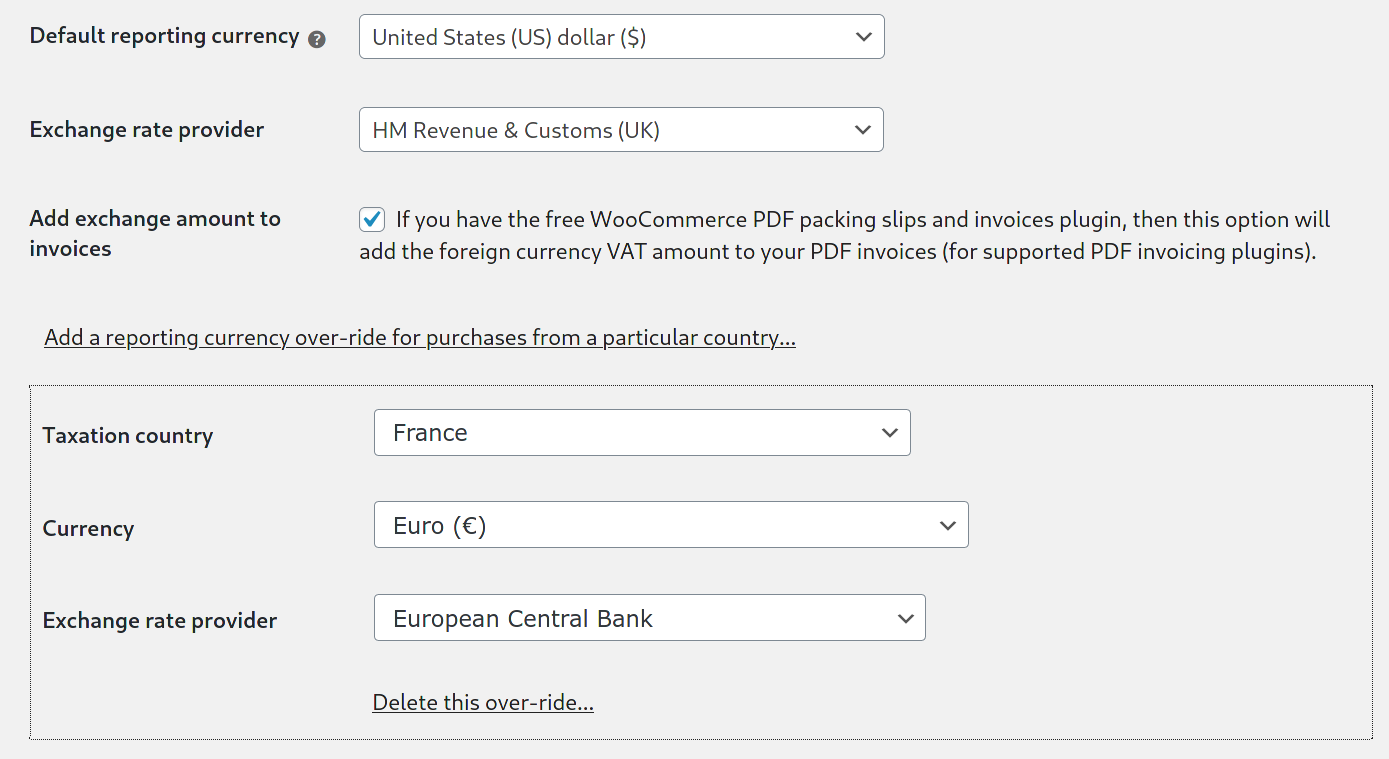

Customer order details in the back-end, showing VAT information (and more technical detail is shown if you hover over different aspects, in case of issues). In this example, the shop is a UK shop, the order was paid in euros by a customer in France, and the shop was configured to automatically carry out a currency conversion using the official rates from the UK tax authority (many other combinations and options are possible):

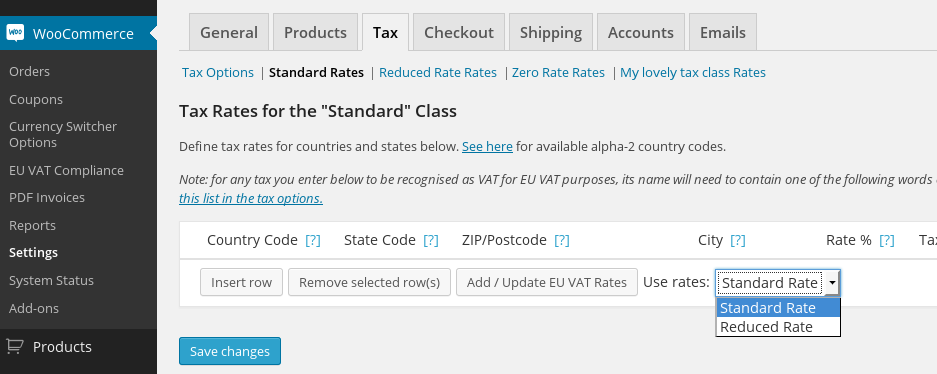

A single button (the “Add / Update” button) allows you to insert or update all VAT rates for EU countries with one convenient click:

Advanced reporting capabilities:

N.B. You can configure the plugin to record amounts for different destinations in different currencies, with different exchange rate sources.

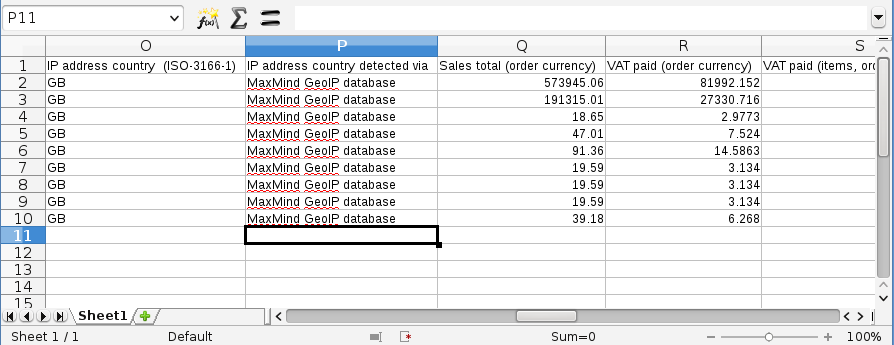

Downloading all compliance information as a spreadsheet:

All relevant options brought into one convenient location:

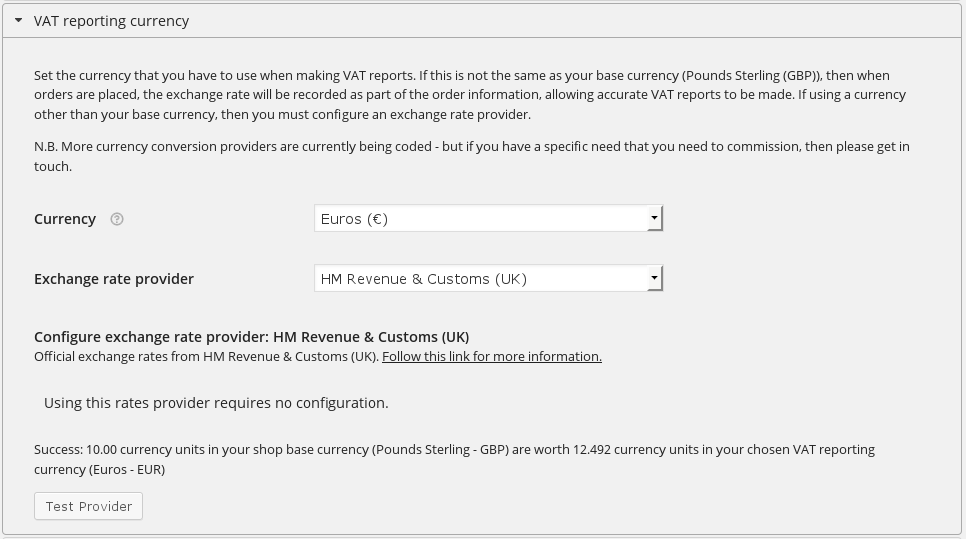

Configuring an exchange rate provider, if your VAT-reporting currency is different to any currency that you sell using. Different reporting currencies for different countries are supported (e.g. if you remit taxes to multiple tax authorities):

Configuring threshold rules for the EU market’s cross-border threshold rules:

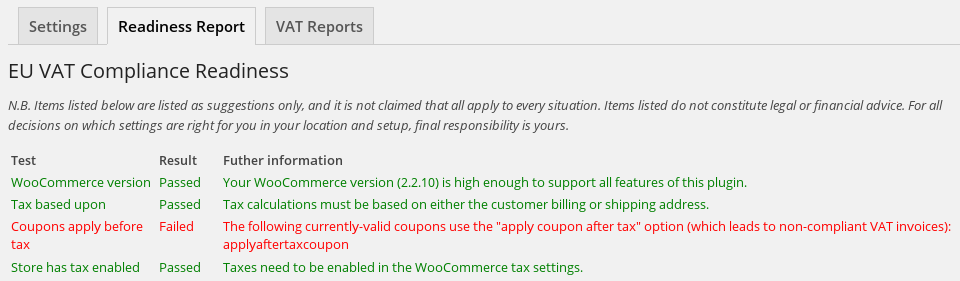

Readiness testing (these can be performed daily, and you can be emailed a notification of any failed tests):